In 2013, Jas Bains was an ambitious young lawyer, enjoying the high life that came with working for an extremely profitable City hedge fund. Today, he is jobless and has lost most of his wealth, having spent years fighting legal battles and attempting to clear his name of association with a huge tax scam.

The irony, he says, is that he blew the whistle on the scam in the first place – only to find himself one of the targets of a £1.4bn lawsuit.

He is reflecting one month after the case ended, bringing to a close eight years of legal arguments and one of the highest value civil cases ever heard in the UK.

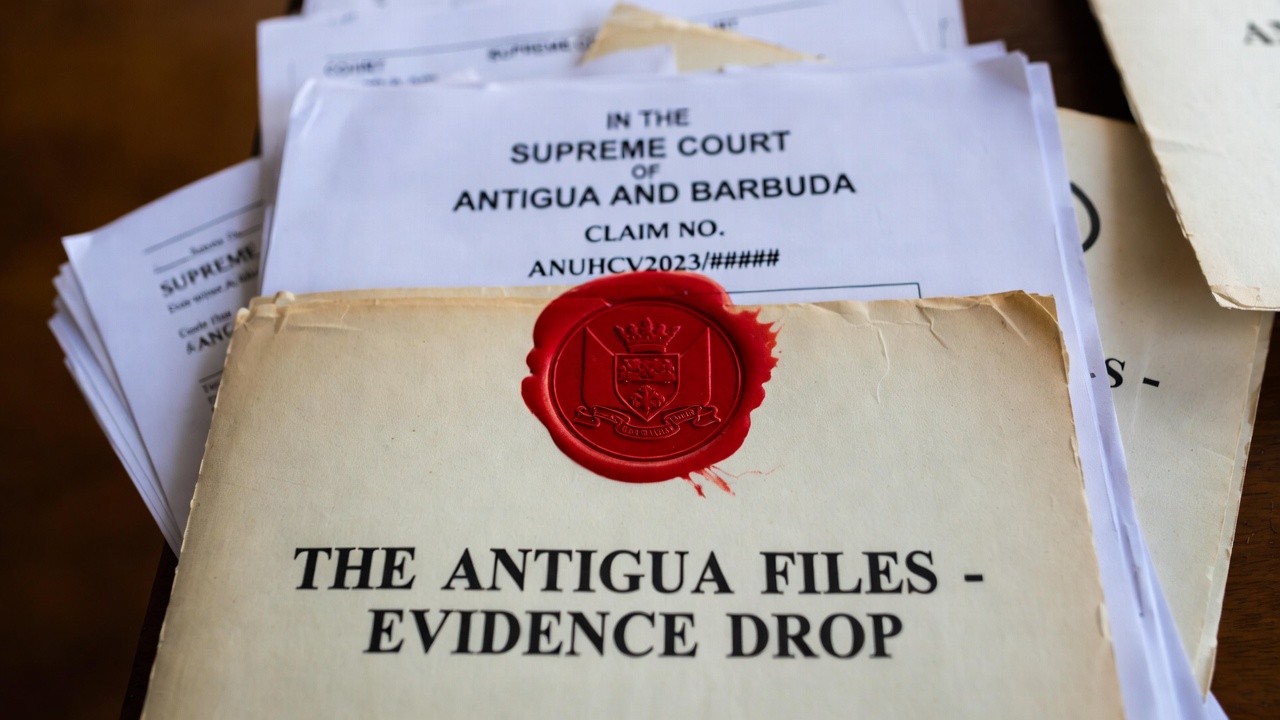

The Danish tax authority was left licking its wounds after failing to establish that a large group of defendants, including Mr. Bains, were liable for huge losses it had suffered.

It all began in 2009 when a banker named Sanjay Shah established a London-based hedge fund called Solo Capital. This fund became heavily implicated in the so-called cum-ex trade, which exploited legal loopholes and resulted in tax rebates being claimed multiple times on the same transactions.

Subsequently, Bains, who had joined as head lawyer, witnessed immense financial excess. However, after leaving the company for a competitor, he became alarmed by the dishonest practices he had observed and decided to whistleblow, contacting Danish authorities.

Danish prosecutors did not target Bains; their focus was on Shah, who was eventually extradited and sentenced to 12 years in prison for fraud. Meanwhile, the Danish tax authority's lawsuit sought to claw back losses from Bains and others.

Recently, however, a High Court judge dismissed the claims against him, asserting that the authority had not proved it was a victim of deception. Bains expressed relief at the outcome, which could allow him to finally move on from this tumultuous chapter in his life.

Despite the win, Bains shares the struggles of finding work amidst the shadow of the lawsuit, highlighting the harsh realities faced by whistleblowers.